Thanks! We’ll be in touch with you soon.

Thanks! We’ll be in touch with you soon.

Thanks! We've emailed it to you.

Accelerate growth through Select Employer Groups (SEG)

Deliver branded financial wellness solutions faster and at a fraction of the cost

Cotribute has been an incredible innovation partner for us. We were able to establish and scale a program that delivers a strong digital experience for our clients’ employee assistance programs. By leveraging Cotribute's platform, we were able to significantly reduce costs and go to market 8 weeks earlier. They have the technology expertise and the business acumen needed to consistently iterate and innovate.

Judah Musick

Chief Innovation Officer - Red Rocks Credit Union

Building internal digital expertise and rapidly delivering a digital product offering is extremely hard for most traditional financial services organizations

Capital intensive

Home-grown digital platforms are expensive and require significant capital investments.

Delayed go-to-market

Building digital competencies and offerings internally often delays your go-to-market.

Risk of Failure

Understanding consumer behavior and getting digital offerings right is notoriously hard and brings a high risk of failure

The proven way to operationalize your digital strategy and go to market quickly

Cotribute’s robust platform does all the heavy lifting and integrates with your core systems and can be configured to match your unique brand and product offering.

The platform that’s delivered results

Users served

Digital analytics attributes

We understand how difficult executing digital growth strategies can be.

Unexpected delays, user experience gaps, low adoption rates - we’ve been there. We know how hard it can be for traditional, financial services organizations to deliver digital experiences that customers love.

See how to launch digital financial products and grow

Cotribute’s robust platform does all the heavy lifting and integrates with your core systems. The platform can be configured to match your unique brand, growth strategy and product portfolio.

Our platform tiers allow you to start small and easily add capabilities as your digital initiative expands.

Essential

Digital giving account product

Custom branding for one financial services organization and their select employer groups.

Support via email

Digital self-onboarding for new customers

Allow users to secure their account with two-factor authentication

Verify new customer identity in realtime using Know Your Customer tools (KYC)

Authenticate and connect with customer’s existing accounts at other banks

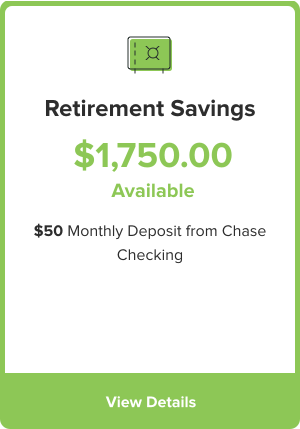

Initiate one-time and recurring deposits

View full transaction history

Automatically provision a giving accounts on customer creation

Allow customers to donate to charities, or support colleagues experiencing a financial hardship

Apply for support for a financial hardship customers are experiencing (end to end managed by Co.tribute’s program partners)

Growth

Everything in Essential

Digital deposit account products

Embed codes for website integration

Dedicated client success manager

Easily configure employer / program branded digital financial wellness portal with multiple products

New customers can apply for a digital product via easy configured application forms

Allow new customers to e-sign applications

Automatically follow up with users who partially complete applications

Setup incentives based on usage of digital financial products

Directly connect to your existing online banking and customer support systems

Synchronize users, accounts and applications on a nightly basis

Batched behavioral analytics reporting

Optionally connect your own charitable partner to manage the hardship application process.

Enterprise

Everything in Growth

Digital loan account products

Single sign-on via ADP

Quarterly executive reviews

Add onboarding tours and educational content to help users understand your products and mission

Initiate one-time and recurring payments

Realtime account balance syncing and behavioral analytics reporting via API

Single sign on via ADP, including ADP user synchronization

Allow customers to setup and manage payroll deductions via ADP

Your path to accelerated growth

Step 2

We do all the heavy lifting to setup your branded digital financial offering

Step 3

Grow your national digital customer base

Popular use cases

View all ↗Rapid Market Testing

Digital Experience POC

Legacy System Integration

Employer Branded Experiences

Automated Account Opening

Income Advance Loans

Instant Earned Wages

ACH Payments

Giving Accounts

Recurring Deposits

Email Nurture Sequences

Rapid Market Testing

Digital Experience POC

Legacy System Integration

Employer Branded Experiences

Automated Account Opening

Income Advance Loans

Instant Earned Wages

ACH Payments

Giving Accounts

Recurring Deposits

Email Nurture Sequences

Frequently asked questions

Does Cotribute provide an API?

Yes, we offer enterprise clients multiple integration options - ranging from API, embeddable components and batch data-synchronization.

Is Cotribute secure?

Yes. Co.tribute is SOC 2 Type 2 certified. We conduct independent third-party security testing and adhere to industry leading encryption, multi-factor authentication and monitoring standards.

Does Cotribute support employer branding?

Yes. The platform can be branded to the financial services organization and the employer clients that they offer digital financial wellness products to.

How long will it take to launch this?

We can launch your first in-market test in 8 - 16 weeks.